Income Taxation By Valencia 6th Edition

Income taxation 6th edition (by: valencia & roxas) suggested answers Problem 3 – 10 A There is no reportable income because there is no actual sale yet during 200x.

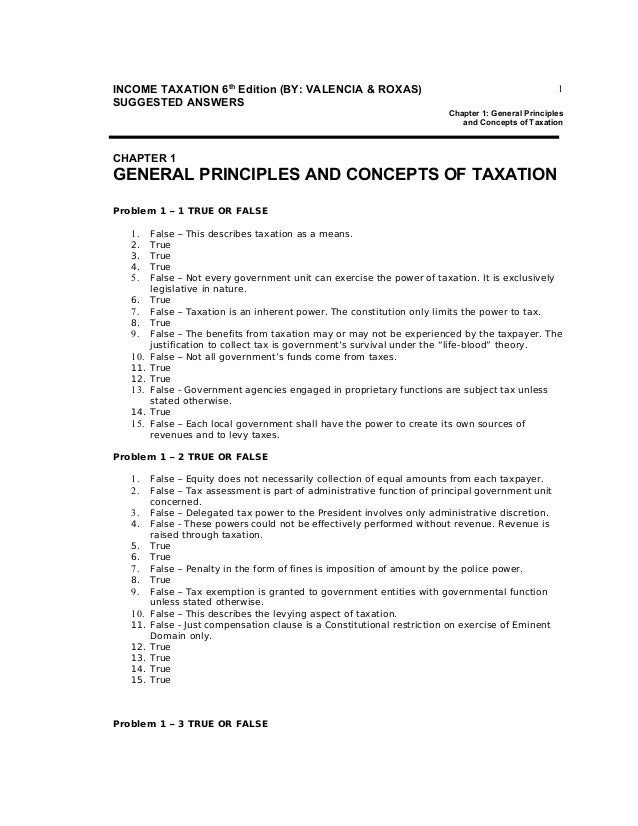

Income Taxation - Answer key (6th Edition by Valencia)- Chapter 3. 1. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 10 Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1. False – Some wealth that made to increase the taxpayer’s net worth are gifts and inheritance and these are not taxable income. False – Sometimes a sale results to loss. False – Filipino citizen who is not residing in the Philippines is taxable only for income earned within.

False – The basis of tax is the fair market value of the instrument. False – Not income for the employee and not subject to income tax because the beneficiary is the employer.

False – Accrual reporting reports income when there is earning regardless of collection. False – Most taxpayer opts for calendar year basis, except corporation which may opt for fiscal year. False – Prepaid expenses are not allowable deductions whether cash or accrual method of reporting income is used. False – There is no rule of 25% initial payment if the sale is made on regular basis of personal goods. Problem 3 – 2 TRUE OR FALSE 1. False- All income distributed are considered as from all income earned outside the Philippines.

False – Only calendar method starts from January and ends at December of the taxable year. False – The reportable income of the decedent’s estate is only the earnings after death. False – Service business is allowed to deduct expenses using accrual method if such business opted to use accrual method, but the income is still reportable using cash basis. True. 11 INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 3: Concept of Income Problem 3 – 3 1. C Problem 3 – 4 1.

C Problem 3 – 5 C Net assets ending (P300,000 – P50,000) Net assets beg.

. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 10 Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1. False – Some wealth that made to increase the taxpayer’s net worth are gifts and inheritance and these are not taxable income. False – Sometimes a sale results to loss. False – Filipino citizen who is not residing in the Philippines is taxable only for income earned within.

False – The basis of tax is the fair market value of the instrument. False – Not income for the employee and not subject to income tax because the beneficiary is the employer. False – Accrual reporting reports income when there is earning regardless of collection.

False – Most taxpayer opts for calendar year basis, except corporation which may opt for fiscal year. False – Prepaid expenses are not allowable deductions whether cash or accrual method of reporting income is used.

False – There is no rule of 25% initial payment if the sale is made on regular basis of personal goods. Problem 3 – 2 TRUE OR FALSE 1. False- All income distributed are considered as from all income earned outside the Philippines.

False – Only calendar method starts from January and ends at December of the taxable year. False – The reportable income of the decedent’s estate is only the earnings after death. False – Service business is allowed to deduct expenses using accrual method if such business opted to use accrual method, but the income is still reportable using cash basis.

True. 11 INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 3: Concept of Income Problem 3 – 3 1. C Problem 3 – 4 1. C Problem 3 – 5 C Net assets ending (P300,000 – P50,000) Net assets beg. Embed Income Taxation - Answer key (6th Edition by Valencia)- Chapter 3. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 10 Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1. False – Some wealth that made to increase the taxpayer’s net worth are gifts and inheritance and these are not taxable income.

False – Sometimes a sale results to loss. False – Filipino citizen who is not residing in the Philippines is taxable only for income earned within. False – The basis of tax is the fair market value of the instrument. False – Not income for the employee and not subject to income tax because the beneficiary is the employer. False – Accrual reporting reports income when there is earning regardless of collection. False – Most taxpayer opts for calendar year basis, except corporation which may opt for fiscal year.

Income Taxation By Valencia And Roxas Solution Manual

False – Prepaid expenses are not allowable deductions whether cash or accrual method of reporting income is used. False – There is no rule of 25% initial payment if the sale is made on regular basis of personal goods. Install kali vmware image.

Problem 3 – 2 TRUE OR FALSE 1. False- All income distributed are considered as from all income earned outside the Philippines. False – Only calendar method starts from January and ends at December of the taxable year. False – The reportable income of the decedent’s estate is only the earnings after death.

False – Service business is allowed to deduct expenses using accrual method if such business opted to use accrual method, but the income is still reportable using cash basis. True.

Income Taxation By Valencia

11 INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 3: Concept of Income Problem 3 – 3 1. C Problem 3 – 4 1. C Problem 3 – 5 C Net assets ending (P300,000 – P50,000) Net assets beg.